Consumer Credit

What’s in Your Score

Your credit score is a numerical representation of your statistical likelihood to repay credit that is extended to you. Mortgage Scores range from 300-850. Your score is a “snapshot” of a specific moment and can change with new actions and the passage of time.

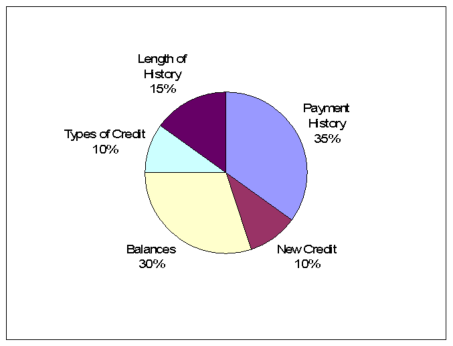

FICO Scores are calculated from different data that can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

The secrets of credit score calculation have been very closely guarded. We can now estimate how your score is put together.

Payment history = 35%

- Do you pay your credit on time?

- Length of positive credit history

- Severity & quantity of delinquencies

Amount owed = 30%

- Quantity of credit Accounts – too many credit cards with balances can lower a score.

Length of credit history = 15%

- The longer the history, the better.

- How long have your credit accounts been established?

- How long has it been since you used certain accounts?

New Credit = 10%

- Research shows that opening several credit accounts in a short period of time does represent greater risk – especially for people who do not have a long-established credit history.

Types of Credit in use (Healthy mix) = 10%

- 2 installment loans

- 3 revolving accounts with balances

- Balances on revolving debt below 30% of the high credit

- No collection accounts

- No public records

- No foreclosures

- No late payments